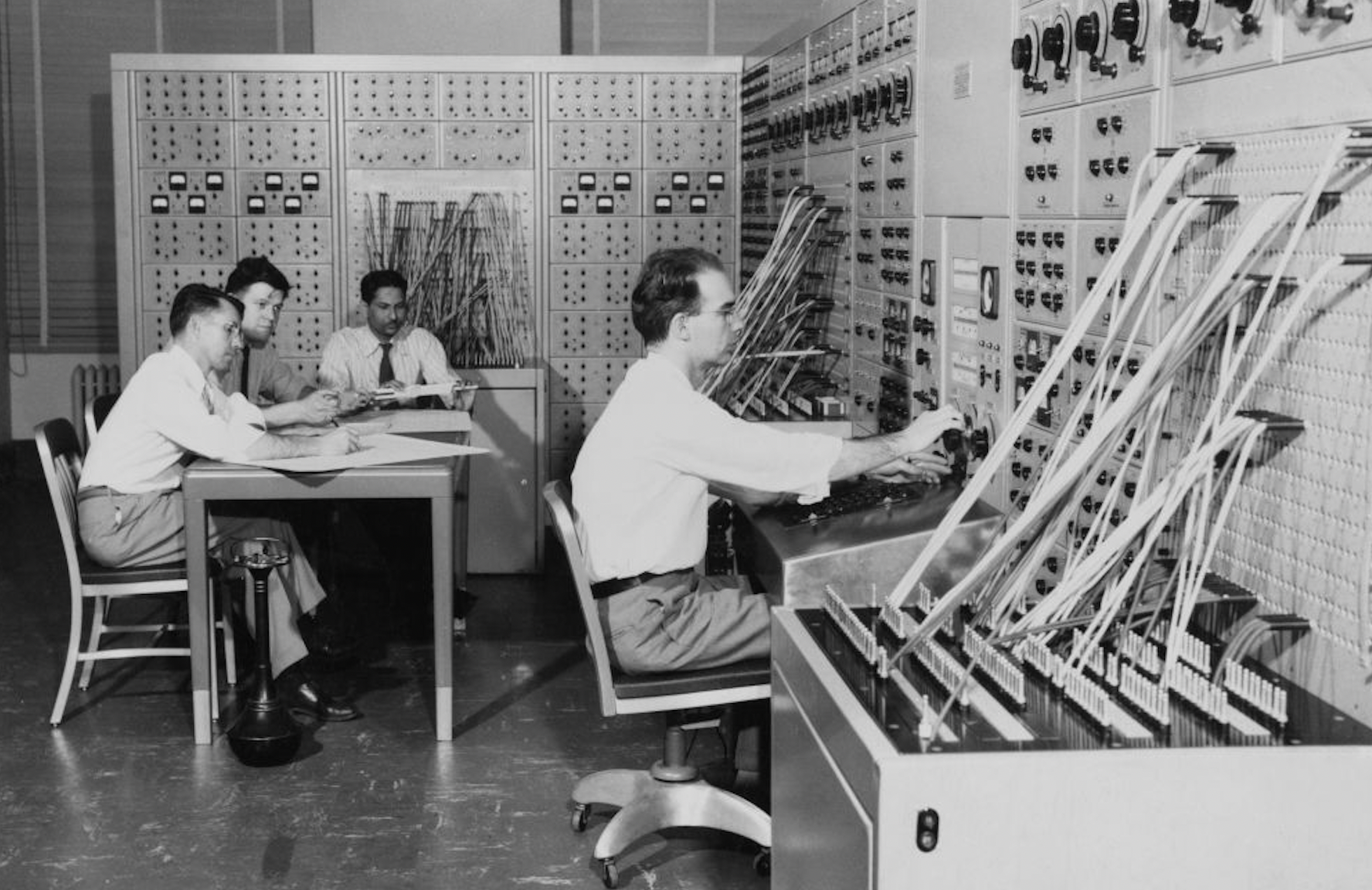

When we need to make a decision, how we analyse and present our data can help us to extract more value from it.

Data and analytics are at the core of intelligent decision-making. When we’ve calculated what we need to measure and collected the right data, we then need to turn that data into actionable information. As former chief executive officer at Hewlett Packard Carly Fiorina says: “The goal is to turn data into information and information into insight.”

While data analysts are the real experts in accessing the deep insights that lie within data, as leaders, we should at least be familiar with the two primary forms of analysis:

Quantitative (based on measurement, i.e. numbers and statistics)

and

Qualitative (based on observation, i.e. interviews, videos and anecdotes).

It may well fall to us to make sense of – and present – the data that we and our teams have gathered, whether we’re facing big decisions about innovation priorities, a strategic change of direction or more routine budget monitoring.

For example, regular sales reports may influence decisions about the future allocation of resources; customer surveys might inform decisions about new product development; employee surveys will give us a steer about how we might structure hybrid working arrangements.

That’s why we can’t entirely outsource basic data analysis and presentation.

Quantitative data – based on measurement

When sorting and presenting quantitative data (such as numbers and statistics) there are a number of fairly straightforward options including:

Numerical count. The number of people who replied to a survey, with qualifying context. For example: '297 out of 350 employees replied to the staff survey'.

Frequencies. How many people fit into a certain category or the number of times a characteristic occurs. For example: ‘Of all survey respondents confirming that they were happy with the company benefits package, 29 were over 40.’

Range. A measure of variability, used to demonstrate how wide ranging the answers were. For example: ‘The age of survey respondents ranged from 18 to 52.’

Rankings: An indication of where a value stands in relation to other values and/or the total. For example: ‘Based on the scores received, the company pension scheme was ranked the most popular part of the benefits package.’

Percentages. Information as a proportion of the whole. For example: ‘87% of company employees make use of the staff restaurant; this shows an 11% increase on last year.’

Measures of central tendency. A measure of what is typical for a group and to identify central characteristics. There are three common measures:

- Mean. The average. For example, if all 297 survey participants stated how are they were, the 'mean' (or average) age, would be the sum total of their combined ages divided by 297.

- Mode. The most commonly occurring answer or value. For example, if part of a survey involved rating on a scale of 1-5 and most people put 4, then 4 would be the modal answer.

- Median. The midpoint, where half of the cases fall below the value and half came above. For example, if 10 students have sat an exam, and we want to establish the median mark, we must arrange their percentage marks from worst to best and establish a midpoint.

Qualitative data - based on observation

Unlike a quantitative survey, where the figures tell their own story, qualitative data often comprises interviews, videos, anecdotes, comments, opinions, and suggestions.

How best to present it is likely to involve a degree of subjectivity, but here are some useful examples.

‘Natural’. In the order it was formulated. E.g. sequentially to represent the natural flow of the subject being observed

Most simple to most complex. To give readers a framework to aid understanding

Quantitative-informed. According to the strategies most commonly found in quantitative analysis, such as frequencies or ranges. For example, categorising the responses of those who are over 25 separately from those who are under 25

Theory-guided. Governed by the researcher’s own theories. For example, if our research is forming the basis of a report, and we are working up to a conclusion, our findings would be used to support this or to provide the evidence for specific recommendations

Major to minor. The most important findings first and the least important last – although what is and is not deemed important can be highly subjective…

It is often said that quantitative data is the ‘what’ and qualitative data is the ‘why’ so reviewing both together is often helpful.

To do this well, we need to consider our priorities: do we need the big picture or something more tactical or operational? A logical flow from quantitative to qualitative data will also help us to see how the numbers and interpretations are connected.

As Hilary Mason, data scientist and founder of Fast Forward Labs so eloquently puts it: “Data is a tool for enhancing intuition.” So, as well as having an ability to see – and share – the insights revealed by the data (and a very human ‘feel’ for what questions to be asking in the first place), we also need the capacity to make decisions off the back of all this learning.

The great thing about being more data-orientated however, is that it can continue to enhance our decision-making over time. By becoming more curious and looking for pattens in the data we gather, we can keep on building our knowledge. And all of this helps to make us better decision-makers – and, ultimately, better leaders.

Test your understanding

-

Outline the difference between quantitative and qualitative data – and two examples (for each) of how to present it.

What does this mean for you?

-

Try presenting data (ideally both quantitative and qualitative) in different ways and note now it aids understanding.